At the beginning of the year, the IBM Institute for Business Value (IBV) invited 44 IBM global experts—members of the Industry Academy and Academy of Technology—to reflect on key trends driving actions and investments across the industry in 2021. We identified the following top themes that will dominate and push banking and financial markets leaders to act:

- Muted financial performance

- Accelerated digital adaptation

- New cloud-based business architectures

- Escalating competition

- Operational resilience challenges

- Increasing open and free data

- Security and fraud risks

- New ways of working

In reviewing the first theme, the industry’s muted financial performance will drive structural cost reduction, a search for new revenue streams, and improved capital efficiency.

The financial performance of the global banking industry remains muted as it tackles a recessionary environment, low interest rates, the expectation of rising non-performing loans, and other macroeconomic events (including, Brexit, China-US tensions, and lockdowns). The structural weaknesses of many financial institutions have translated into poor financial performance across many key industry metrics.

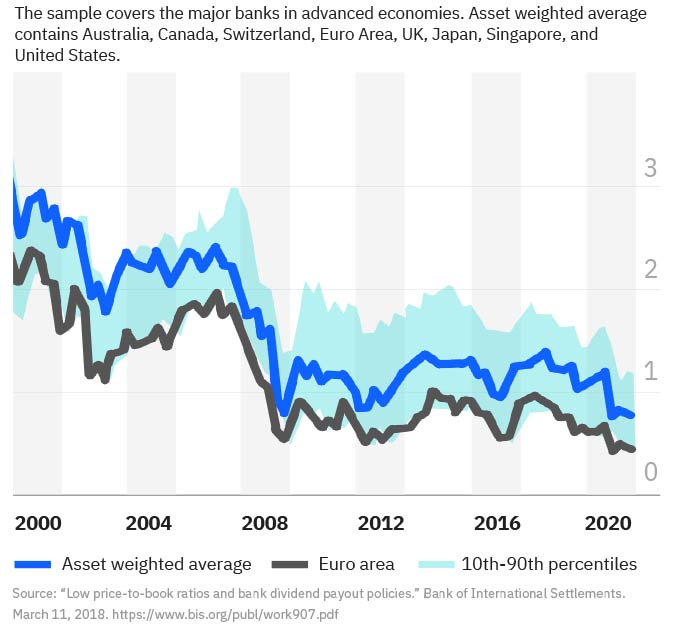

For example, the industry’s overall return-on-equity has been below its cost-of-equity since the global financial crisis in 2008. According to a recent report by the Bank of International Settlement (see, “Low price-to-book ratios and bank dividend payout policies”), this is reflected in current market valuations. The industry’s price-to-book has traded at a discount to the average of other industries since the financial crisis, and as much as a 50% discount recently.

Quarterly price to book ratio of major international banks from 2000 to 2020

Most banks still traded at a significant discount since 2008 compared to non-banking and cloud-native financial competitors, and their valuations continued to diverge during the pandemic. European banks appear most disadvantaged compared to many other regions. In early January 2021, the EURO STOXX Banks index was down almost 85% compared to its peak in 2008.

A fragile economic recovery

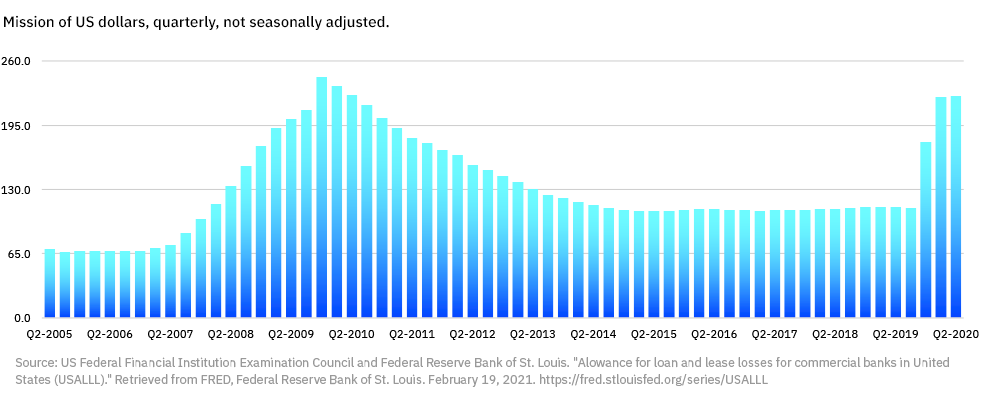

During the pandemic, protracted under-performance has been compounded by a decline in revenues and rising loan loss provisions in virtually all economies.

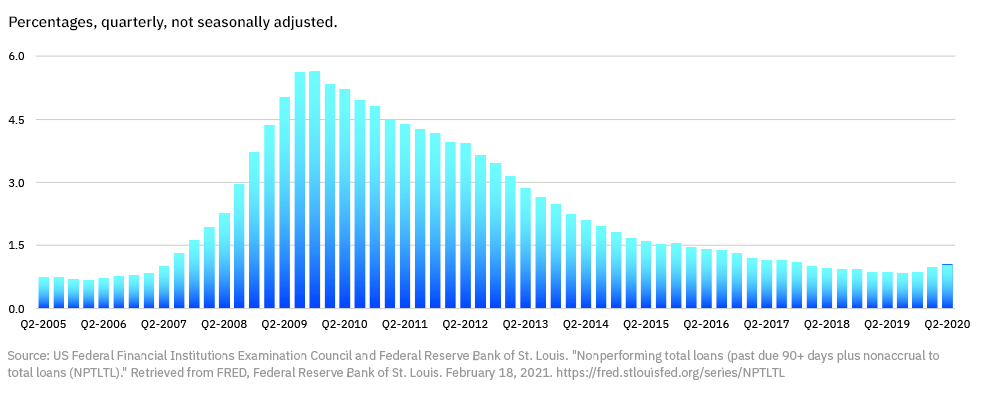

A global increase in impairments and provisions has already affected bank net profits in 2020, as evidenced in the Euro zone by the European Central Bank (see, “Supervisory banking statistics for the second quarter of 2020”). Although non-performing loan (NPL) ratios had been declining globally after the height of the global financial crisis (GFC), that financial institutions took substantial loan loss provisions in the first three quarters of 2020.

The industry has not yet taken significant actual write-offs due to government stimulus actions and forbearance programs designed to support individuals and businesses. However, loan losses are likely to materialize in almost every segment of the industry including credit cards, commercial real estate, and small businesses.

Nonperforming total loans (NPL) ratios for US banks

Nonperforming total loans (NPL) allowances of US banks

A gloomy outlook for a further dip in revenues through a recessionary economic cycle is reinforcing concerns of poor return on equity (ROE) performance in 2021.

Notwithstanding the many weaknesses, banks appear better equipped and in a stronger capital position compared to 2008, partly because of regulatory reforms implemented in the last decade, operational transformation initiatives, and a protracted effort to de-risk credit portfolios. We learned from the GFC that financial institutions which reacted quickly and took decisive operational and financial actions, achieved faster recovery in financial performance.

While financial institutions have endeavored to diversify away from lending-driven revenues, credit continues to be a mainstay for the industry. As reported in the US Federal Reserve statistics, net interest margins for US banks have halved in the last 15 years, from almost 5% in 1994 to a meager 2.8% at the end of 2020. The decades-long compression of net interest margins was accelerated during the pandemic, creating an urgency for the industry to find new sources of revenue.

The current business and technical architectures of many financial institutions is simply not designed to respond to a challenged macroeconomic environment with a new competitive landscape. They must drive transformational changes to their business and operating models to deliver ROE expectations of investors.

Leading institutions take actions to emerge stronger

Banks can steer returns to acceptable levels by focusing on the three following areas: new revenue streams, radical cost reduction, and improved capital efficiency and risk management.

1. Search for revenue growth. Net interest income has always been a core driver of the industry’s revenues. However, central banks’ expectation of a long period of low-to-negative interest rates is inducing a severe erosion of net interest income. To mitigate margin compression, banks can focus across several areas:

- Targeting fee-based services around customer needs. A clear imperative is to create customer-centric, fee-based income streams. This may be achieved by developing a deeper understanding of clients to gain more accurate insights into their financial needs. As an example of this type of move, Standard Bank is digitizing its systems to fend off fintech companies invading its customer base with a redesigned management structure split into customer focused segments—consumers, high net worth individuals, and wholesale client business—to develop more segment specific propositions.

- Capturing value beyond banking. Digital platform players have realized the power of building around customer ecosystems, reducing friction across industry value chains to deliver on customer needs. Financial institutions can learn—by going beyond banking—to integrate their products and services into customer ecosystem platforms. Building or participating in platform business models allows financial institutions to capture a greater share of the broader value incorporated into ecosystems. For example, DBS has launched several marketplaces to serve property, travel, cars, and utilities ecosystems. And the State Bank of India’s YONO (You-Only-Need-One) application connects to non-banking client journeys offering lifestyle products. Clients can onboard to a digital bank with access to a financial superstore for investments and other services, all connected end-to-end by analytics.

- Optimizing funding. Banks can improve their net interest income revenues by seeking ways to lower funding costs through improving stability of their deposit base and minimizing liquidity buffers.

2. Radically and structurally reduce costs. The improved maturity and accelerated adoption of exponential technologies has created more potential value and business opportunities for banks with an open hybrid multicloud architecture (see, “Banking on Open Hybrid Multicloud”). This move to a modular architecture allows banks to scale to demand with higher automation, platform-oriented interactions, cloud-native interoperability, and agile configurations.

Specific ways financial institutions can reduce costs with technology include:

- Accelerating digitization of engagement. Accelerating the digitization of customer engagement and the reconfiguration of branch networks and contact centers can deliver a significant reduction in distribution costs while responding to changed customer behaviors and expectations.

- Implementing intelligent workflows. Aligning data, customer experience, and technologies can reduce or eliminate the use of traditional processes (such as, design for no operations). This can create intelligent workflows that leverage cognitive tools to enhance automation paths and enable authorization across multiple devices to enhance the employee and customer experience.

- Modernizing the application portfolio. Cost and complexity are the main inhibitors when approaching modernization of legacy applications. Leveraging next generation DevOp tools, accelerators, and artificial intelligence (AI)-driven automation for more seamless application management, financial institutions can drive the modernization of existing applications and infrastructure to create the development and deployment of workloads that run on any computer platforms.

- Migrating to open hybrid multicloud architecture. Hybrid cloud architectures can release the value of trapped data and functionality, along with handling the transition between old and new applications on multiple compute platforms. Hybrid cloud can also de-risk architectural choices through “build once, deploy anywhere” approaches.

- Lowering costs with new collaboration models. Banks are shifting from the traditional front-office and back-office working models to multidisciplinary teams of employees, subcontractors, vendors, partners, and automated robots working together in new collaboration models, accelerated by remote working. New working models enable greater employee productivity at lower costs.

3. Improve capital efficiency. Facing macroeconomic uncertainty and a fast-evolving industry structure, financial institutions are asked to deploy improved capital management capabilities to make tactical and strategic decisions on their business portfolio. They are steering credit exposures to appropriate levels of risk appetite, improving asset-liability management, calibrating risk models to the emergence of a new economic and financial normal, better risk management of credit exposures, and planning for sustainable capital management.

Conventional sources of data to support risk-based decision making became meaningless overnight due to the pandemic outbreak and its impact on global economies and capital markets. New unstructured data points and the real-time monitoring of client behavior and interactions became even more important. Banks embracing new data-driven processes and forward-looking approaches to credit risk management might gain clear competitive advantage.

Looking beyond the pandemic

In contrast to the overall financial services industry, cloud-native institutions and payment providers are emerging stronger from the pandemic. These types of businesses, along with new entrants, are equipped with the latest AI and cloud technologies and can deliver services faster and at a lower cost per transaction, which has increased the urgency to modernize for many organizations.

Segments that did well

According to The Financial Times, only two financial services firms ranked in the top 15 large companies in terms of rising market cap in 2020: Visa and PayPal. Both companies are seeking to embed themselves in new business models. Most financial institutions underperformed, with the bottom 15 featuring a set of well-known names among tier one financial institutions.

Payment providers lead with digital transformation

Demands for better customer experiences or cost reduction are fuelling the need to modernize and digitally transform. For example, consumers have an expectation that digital payments can be immediately fulfilled using any device, network, and channel. Competition and regulators have reduced processing fees, and corporate treasurers are increasingly expecting better experiences from faster payments and richer data, thereby making liquidity management easier and more transparent.

Industry consolidation

Not surprisingly, mergers and acquisitions re-emerged in 2020, potentially signaling the start of a new wave of consolidation for scale efficiencies. In Spain, mergers were announced by Bankia and Caixabank, as well as Unicaja and Liberbank. In Italy, Banca Intesa Sanpaolo acquired UBI Banca. In the US, PNC acquired BBVA USA’s operations.

Amid all this uncertainty, one thing appears certain: Financial institutions can improve financial returns with the acceleration of the financial sector’s digital transformation and migration to a new business architecture.

To learn more about key actions for banks facing muted financial performance in a post-pandemic business reality, you can download the IBV report, "Essentials for the post-pandemic bank."

Meet the author