Amid COVID-19, insurers around the world are facing both direct and indirect impacts to their business that will reverberate through the industry for a long time to come.

Insurers are experiencing pressure on their workforce, with insurance workers and distributors in lockdown. They are also dealing with books of business with impact from higher mortality and contractual coverage disputes, and market environments where risk is top-of-mind, but buying insurance from an agent is not.

At the same time, the insurance industry is feeling the effects of fundamental changes in the broader business and social environments in which they operate. Economic and political responses to COVID-19 have varied widely, with different lockdown and quarantine rules for different populations and businesses. Almost all populations, however, have rapidly seen significant changes in day-to-day life and in financial stability. Their customers’ major changes to work and life interactions, combined with significant global economic disruption, are not only affecting business today, but will likely result in permanent changes to the economic and cultural landscape even after COVID-19 is brought under control.

In the short term, our insurance clients need to:

- Support their workforce as they shift to work remotely, with new technology needs in applications, security, and networking, and cultural needs like workforce support and process changes

- Find ways to connect and serve their customers in a remote environment, handling the stress on voice customer engagement channels and on direct digital interaction and advice

- Address their financial pressures related to the potential for increased reserving and claims, uncertain investment returns, and low prospects for short-term sales to fill those gaps

- Account for increased volume of claims and benefits discussions, and likely increases in questions, disputes, and eventual litigation.

The bigger insurance picture

Many insurance companies are structured in a poor interaction model, considering today's environment. They sell a policy that is complex and intangible, often with significant back-and-forth around underwriting and contract terms. They charge increasing premiums over time for a product that most buyers do not interface with frequently. And when something bad happens to the buyer—like a worldwide pandemic and financial collapse—contractual disputes are initiated surrounding contract terms.

Clearly, neither those processes, nor traditional insurance products and their distribution channel mix, fit well in this new COVID-19 world. They are too reliant on a long sales process involving sales techniques that will have difficulty adapting to digital interaction. And the products themselves do not fit a world where apps can be downloaded for small sums and insurers can provide new products directly through other industries, such as travel insurance embedded within an airline website. Insurers will need a new toolkit.

Insurers, in fairness, know they need to change their model. However, they remain saddled with legacy systems’ inflexibility and high cost. Their sales and servicing model is labor-intensive in many cases as a result, and building new risk products and services is cumbersome and slow. Improving insurance products and services will require resolving this technical debt, in an environment where insurers themselves may be under financial pressure.

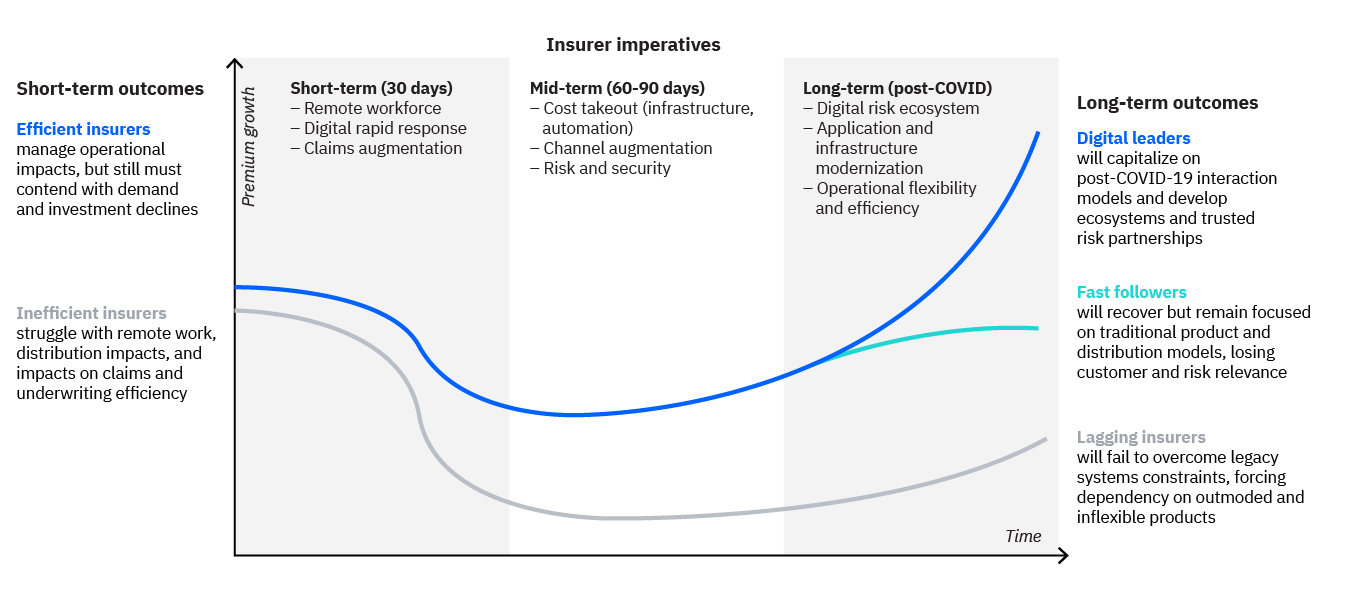

These pressures will accelerate a separation of insurers, and insurtechs looking to disrupt them, into clearer divisions. Differences in insurer investment strategy now will become magnified post-COVID-19. This divergence will reward leading insurance innovators that can operate across the risk product and service spectrum. It will also penalize severely those that fall behind.

Re-engineering for the post-COVID-19 insurance future

To survive and thrive amid COVID-19 and beyond, insurers need to prepare and invest in the following areas:

- Stabilize. Change will be challenging until basic operations and financial position are brought under control. Building the systems for long-term remote operations and arms-length insurance interactions with customers will be essential. Insurers will also need to respond to financial pressures with low-hanging IT cost reduction, simple digital channel augmentation, and AI-powered automation and assistance tools to improve underwriting and claims throughput and quality. Clients are working with us today on workforce enablement, claims automation, and digital assistance tools.

- Build resilience. Movement of core operational systems to a more consolidated, cloud-based set of services can add flexibility to insurance product models while reducing costs. Cloud-based API frameworks can speed implementation of new risk partnerships and enable insurance as a service. Insurers will look to create this resilience while maintaining security, monitoring, compliance, and scalability, and avoiding needless lock-in. Clients are working with us to build and institute insurance-specific cloud offerings, including deployment of our input management solution in a COVID-19 context.

- Stride forward. In the post COVID-19 world, insurers will need digital tools that are adapted for this new age. Insurers must easily build and adapt digital interactions and integration with other industries via microproducts, AI-tailored advice, value-added service ecosystems, and holistic risk solutions. The firms that achieve this will be positioned not only to capture insurance market share, but to expand into entirely new markets and business models. Our forward-thinking clients are building new combined product/service risk offerings today to solve challenges ranging from eldercare and driving improvement to supplier resiliency.

Insurers, like all of us, are working incredibly hard to address the impact of a major world threat in COVID-19. Balancing short-term actions with plans for the longer-term COVID-19 future will better position insurers to offer relevant risk products, services, and advice. The insurance industry, if we can take advantage of these new risk offerings, can help prepare the world for risks that are like COVID-19, as well as risks that aren't—an essential function for our future.

To support our clients, IBM has developed best practices and recommendations for actions to take now and after the pandemic. Click here to access our COVID-19 Action Guide and related resources.

Meet the author