As the COVID-19 pandemic continues to spread around the world, its toll on human populations has been accompanied by the disruption of supply chains, industries and whole economies. Almost overnight, people’s lives, business, and countries have had to change.

In the near term, financial institutions in countries affected by the pandemic moved quickly to safeguard their employees, transform their operations, and serve their customers in new ways. Almost immediately, financial institutions have:

- Mobilized control centers and enabled their employees for remote working

- Closed branches and reconfigured, augmented, and secured operations to support changing volumes and business continuity

- Started to adapt their risk and fraud models.

The post-COVID-19 environment will be very different. Many economies will likely be recessionary for an extended period. Financial institutions will have to reconfigure their business and operating models for an environment of higher numbers of non-performing loans and defaults, low interest rates, credit tightening, and capital constraints.

Post-COVID-19 market environment

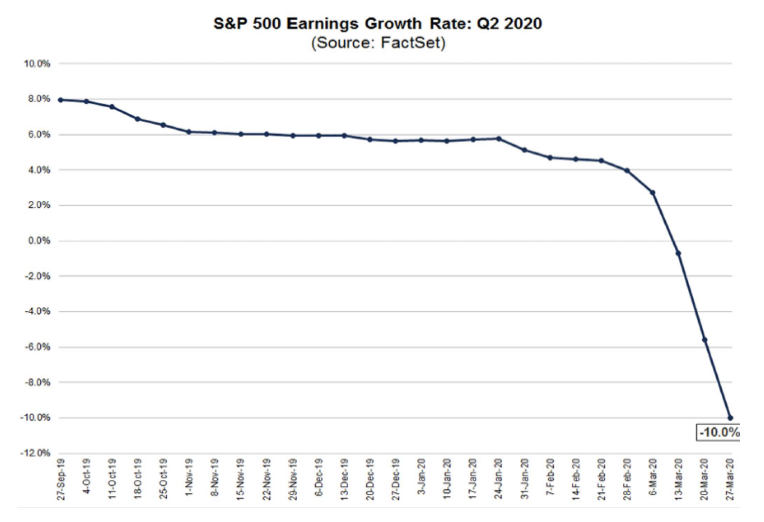

We expect the global economy to be recessionary. On March 23, 2020, the Institute of International Finance projected a global GDP contraction of -1.5 percent for 2020. Analysts expect S&P earnings to fall 25 percent.

The biggest impact will be due to lower consumption, weaker business investment (as firms reconsider investments), and lower inventory accumulation arising from a combination of supply shock and weakened demand.

Higher credit defaults: Banks have enjoyed record low non-performing-loan (NPL) performance in recent years. Asset-quality deterioration seems likely given the economic disruption caused by business closures and stay-at-home requirements. Depending on the scale of federal assistance programs, defaults are likely to be higher than during the 2007-2008 global financial crisis.

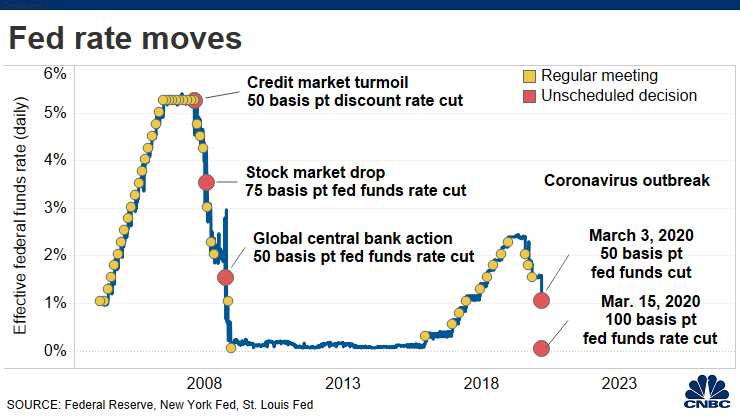

Low interest rates: Many central banks around the world have reduced interest rates to support their local economies. The rapid pace of cutting interest rates will accelerate the compression of net interest margin, impacting a key and significant revenue stream for the banking industry.

Credit tightening: There is also the potential for credit tightening, where there will be a lack of funds available in the credit market, making it difficult for borrowers to obtain financing. This could be driven by lenders having limited funds available to lend, being unwilling to lend, or increasing the cost of borrowing to a rate that is unaffordable to individual, business or bank borrowers.

Capital requirements: Substantial buffers on capital and liquidity have been put in place since the last decade’s financial crisis with its worst-case estimated declines in global GDP of 5 to 7 percent. Before the COVID-19 pandemic, the banking industry had common equity capital between 12 to 14 percent. There are now concerns whether the capital and liquidity buffers they have built will be sufficient.

The “next normal” for the financial services industry

Radically lower cost structure

Financial institutions will have to act quickly to cut more cost, and uncover new savings and efficiencies. They will also have to become more nimble, flexible and resilient to market threats. With the accelerating compression of net-interest-margins, and the looming decline in fee income, financial institutions will have to quickly and substantially reduce their operating expense in order to maintain profitability.

The “go-to” cost savings areas for financial services will need to be:

- Substantial: Cut greater than 40 percent to reflect new economic and competitive realities

- Structural: Be structural in nature, going beyond being capacity-reducing

- Sustainable: Deliver a sustainable cost structure without impacting customer, resiliency, compliance, and security requirements.

Operational resiliency

The rapid impact of COVID-19 on the global economies has reinforced the importance of operational resilience. Operational resilience will become critical with the mounting risks of further pandemics, societal and geopolitical tensions, intensity of cyber-attacks, and other unknowns that continue to target the financial services industry.

In addition, the regulators are likely to be hypervigilant, levying severe fines on banks which suffer breaks in service that impact customers. Financial institutions will acknowledge that, to succeed, they must invest in preparation, expect failure and invest in recovery.

Extreme digitization on cloud

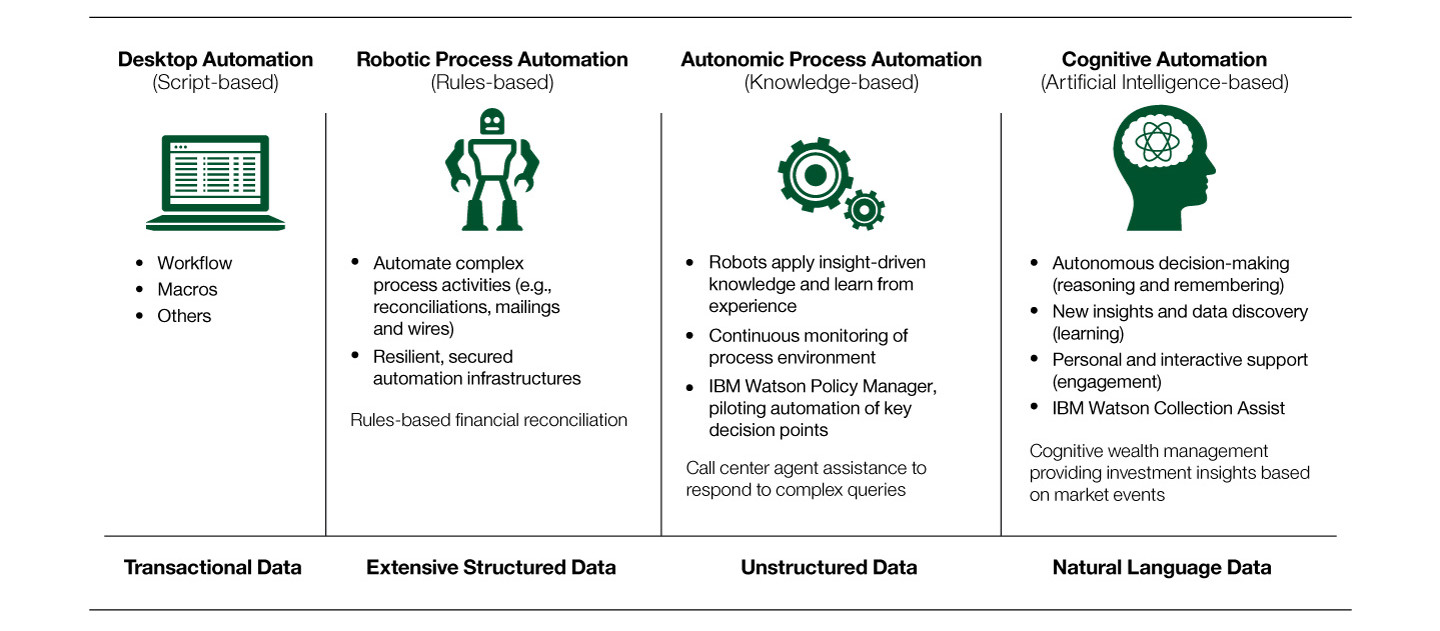

Extreme digitization will start with evolving the customer experience—creating more cohesive and personal digital journeys by combining and integrating every aspect into a single platform and tooling. Moving beyond the customer interface, digitization includes middle- and back-office operations, and support functions where processes are transformed and automated into intelligent workflows.

Delivering on this goal requires powerful exponential technologies like cloud, automation, API platforms, blockchain, and AI, as well as an agile approach to delivery, design thinking and organizational integration. Extreme digitization is developed on an open hybrid cloud platform that enables financial institutions to securely build, run and manage apps and workloads in a consistent way, across any cloud.

Reinvented customer relationships

Remote working and consumption has changed the routines and expectations of customers, in terms of digital adaptation. In many times of crisis, a flight-to-quality or flight-to-safety occurs when customers migrate to environments that are perceived to be less risky, even if they actually prove otherwise. In financial markets, it happens when investors sell what they perceive to be higher-risk investments and purchase “safer” investments, such as gold and other precious metals. In retail banking, an example is moving your savings from smaller, newer banks to larger, more established players.

Secure and compliant to the core

The post-COVID-19 environment will continue to see expanding channels, increasing interconnectivity, digital platforms and 24x7 access. Yet each of these enhancements can drive increased security risks, threats, and fraud.

Successful players will seek to embed security and compliance across their operations and technologies to drive efficiency and effectiveness. This will include automation, leveraging data and analytical tools, employing pervasive encryption, and the next normal of culture and conduct risk expectations.

Starting the journey to the next normal includes aggressively modernizing the application portfolio, migrating to resilient and secure clouds, driving the digitization of processes into intelligent workflows, building self-serve capabilities, embedding security and compliance across operations, and designing a new relationship with customers. To support our clients in these actions, IBM has gathered together a set of best practices and recommendations in our COVID-19 Action Guide, as well as related resources.

Meet the author